Our Advisors Financial Asheboro Nc Ideas

Wiki Article

The Financial Advisor Job Description Diaries

Table of ContentsThe 8-Second Trick For Financial Advisor DefinitionThe 6-Second Trick For Advisors Financial Asheboro NcThe smart Trick of Financial Advisor Job Description That Nobody is Talking AboutFinancial Advisor - QuestionsThe smart Trick of Financial Advisor That Nobody is Talking About

You should additionally take into consideration just how much money you have. If you're searching for an expert to handle your cash or to aid you spend, you will require to fulfill the advisor's minimum account demands. Minimums differ from expert to expert. Some may collaborate with you if you have simply a couple of thousand bucks or much less.

You'll after that have the capability to interview your matches to locate the ideal fit for you.

Some Known Questions About Financial Advisor Salary.

Before conference with an advisor, it's a good idea to believe concerning what kind of consultant you need. If you're looking for specific guidance or services, consider what kind of financial advisor is a specialist in that location.

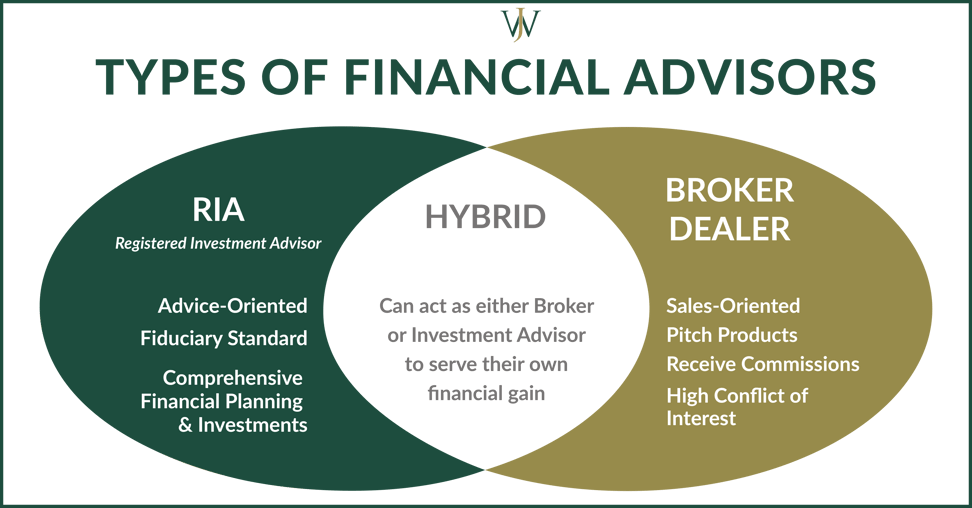

Which one should you work with? We find that, typically, individuals seeking monetary guidance understand to try to find a monetary expert who has high degrees of integrity and that intends to do what is in their customers' benefit at all times. It seems that less individuals pay focus to the orientation of their monetary consultant prospects.

Examine This Report about Financial Advisor License

Below's a consider four various kinds of experts you are most likely to experience as well as just how they compare to each various other in some essential locations. Armed with this details, you must have the ability to much better assess which type is finest suited for you based on aspects such as your goals, the intricacy of your economic scenario and your total assets.Financial investment expert. Investment advisors are superb financial specialists that do a really great work managing moneybut that's all they do. While financial investment advisors offer a solitary solutionmoney managementthat one solution can have multiple variants (from safeties to investments in exclusive companies, actual estate, artwork as well as so forth).

, one need to initially obtain the necessary education by taking monetary expert training courses. Financial consultants have to have at least a bachelor's level, as well as in some cases a master's is advised.

The Buzz on Financial Advisor

Financial experts will need this foundation when they are advising customers on reducing their threats as well as conserving money. An additional location of research concentrates on investment planning. In this course, trainees discover exactly how the supply market jobs together with various other financial investment techniques. When working as an economic expert, understanding of investment planning right here may show crucial when trying to create investment techniques for customers., such as transforming a headlight or an air filter, however take the auto to an auto mechanic for big jobs. When it comes to your funds, however, it can be harder to figure out which jobs are DIY (financial advisor fees).

There are all click reference type of financial pros available, with dozens of various titles accountants, stockbrokers, money supervisors. It's not constantly clear what they do, or what sort of issues they're geared up to manage. If you're feeling out of your depth financially, your first step must be to learn that all these different financial professionals are what they do, what they charge, and also what choices there are to employing them.

Not known Facts About Financial Advisor Magazine

1. Accountant The major factor the majority of people employ an accounting professional is to help them prepare and submit their income tax return. An accounting professional can aid you: Fill up out your tax obligation return appropriately to prevent an audit, Locate deductions you may be losing out on, such as a residence workplace or child care deductionSubmit an extension on your taxes, Invest or contribute to charities in methods that will certainly decrease your tax obligations later on If you own financial advisor advocacy an organization or are starting a side organization, an accountant can do other work for you.

Your accounting professional can also prepare economic declarations or reports. How Much They Cost According to the National Culture of Accountants, the ordinary price to have an accounting professional file your taxes varies from $159 for a basic return to $447 for one that includes service revenue. If you desire to hire an accounting professional for your organization, the cost you pay will certainly rely on the size of the firm you're managing and also the accountant's level of experience.

Report this wiki page